20+ Property Tax Calculator Ohio

Web Table PR-6 shows average property tax rates for taxes due in calendar year 2020 in each of Ohios counties. Web Enter Property Value and select other options to estimate 2022 property taxes.

Ohio Mortgage Calculator Nerdwallet

Is the property ResidentialAgricultural.

. Your average tax rate is 1167 and your marginal tax rate is 22. Web 1 How are real estate taxes calculated. Web Table PR-6 shows average property tax rates for taxes due in calendar year 2022 in each of Ohios counties.

Web All estimates are for tax year 2022 taxes paid in 2023. For comparison the median home value in. Ohio capital gains tax.

The assessed value of the. Web Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. The rates reflect all levies by all jurisdictions school district county.

If you make 70000 a year living in Ohio you will be taxed 9455. Web A simple percentage is used to estimate total property taxes for a property. Web The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202425.

Web Property taxes are the major source of revenue for your city and other local governmental districts. Web Estimate My Wood County Property Tax. Along with the county they count on real property tax revenues to perform their.

The departments Tax Equalization Division helps ensure. The rates reflect all levies by all jurisdictions school district county. Our Wood County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your.

Web The real property tax is Ohios oldest tax. Web Ohio property tax. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

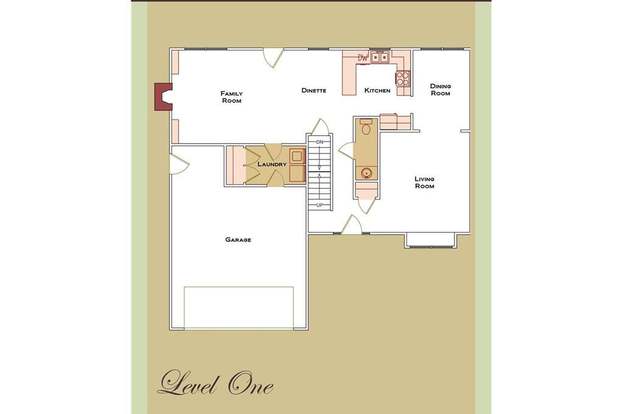

Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Web AppraisedMarket Value What the property is expected to sell for at a given point in time AssessedTaxable Value 35 of the appraisedmarket value for real property. This tool can only estimate 2022 property taxes This estimator will be updated.

To estimate your tax return for 202425 please select. You pay real estate taxes on the assessed value 35 of the propertys appraised value of your property. It has been an ad valorem tax meaning based on value since 1825.

To find this estimate multiply the market value of the property by the percentage listed for your. Ohios property taxes are higher than the national average with an effective average rate of 157. The eligibility criteria to receive the full stimulus payment include.

Tax Estimator County Treasurer Website Seneca County Ohio

Cep And Champaign County Ohio Economic Project News And Developments Champaign Economic Partnership Cep Ohio

Tax Estimator County Auditor Website Wayne County Ohio

Swapcard The Event Mobile App Spe

Greater Dayton Communities Tax Comparison Information

20 Chase Ct Springboro Oh 45066 Mls 745518 Redfin

Candidates For County Administrator Announced Unified Government Of Wyandotte County And Kansas City

How Property Taxes Are Prorated For Residential Sales In Greater Cincinnati Cincinnati Real Estate Cincinnati Homes For Sale By Kathy Koops

2023 How Much Does A Machinist Make An Hour Working Hour Kiretuj Online

Fmgtnl Z6ahbbm

Canton Ohio Crime Rate 2023 Is Canton Ohio Safe Crime Map Statistics Safest Areas

Life Lessons From Accomplished Investor In 20 Syndications

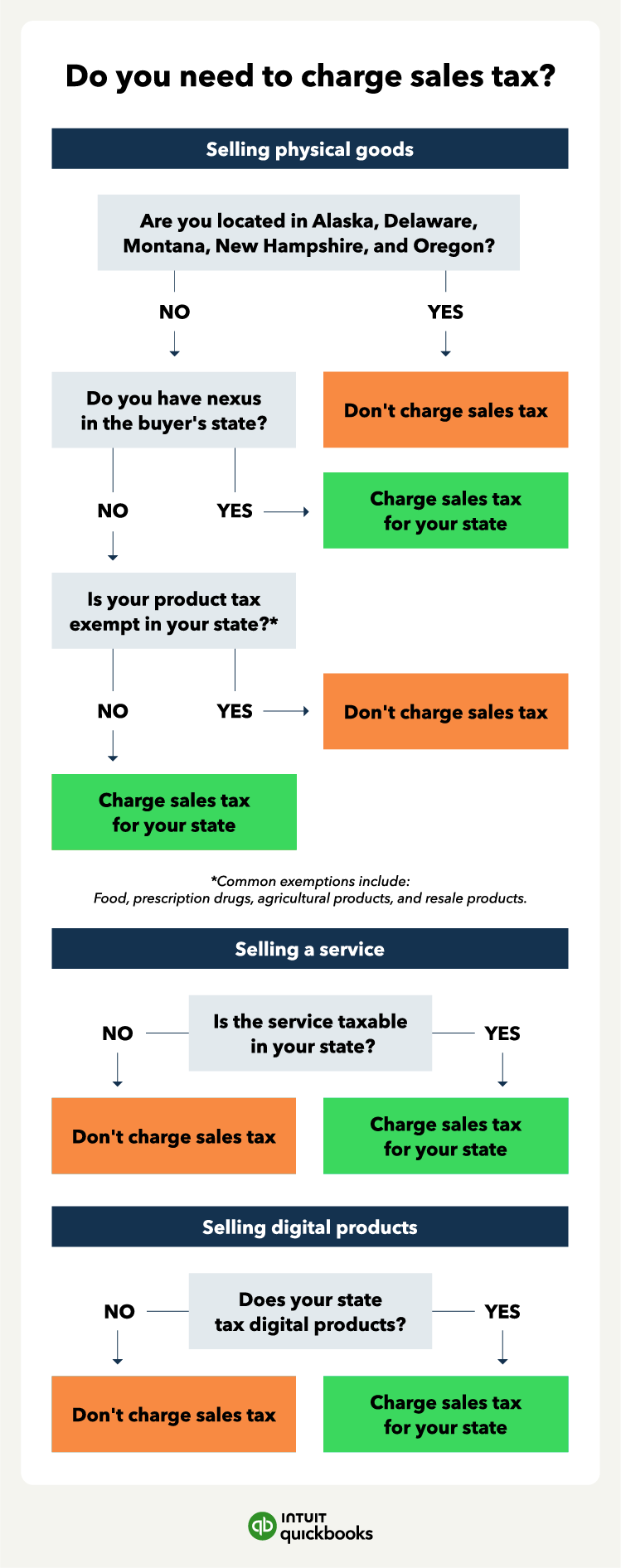

Do I Need To Charge Sales Tax A Simplified Guide For 2023 Quickbooks

2609 E Main St Springfield Oh 45503 Walgreens 4m 15yr Abs Nnn Rental Increases Loopnet

Slide 03 Jpg

Ada Tax Credit For Web Accessibility Guide For Business Owner

With New Health Law Sharp Rise In Premiums New York Times 20 Other Outlets Quickread News For The Financial Consulting Professionalquickread News For The Financial Consulting Professional